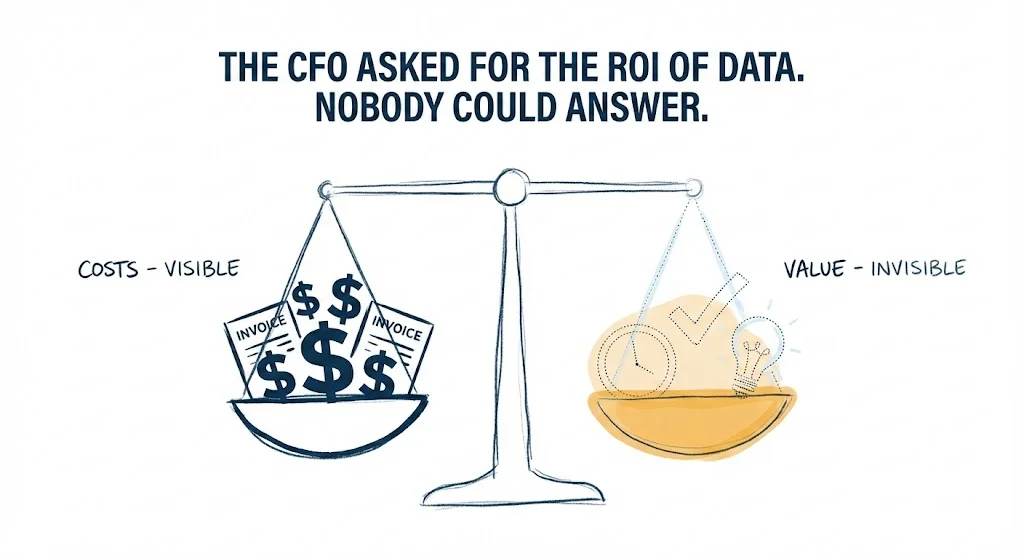

The CFO asked for the ROI of data. Nobody could answer.

Data platforms have clear costs. Licensing. Infrastructure. Team headcount. The invoice arrives monthly.

The returns are less obvious. Decisions happen more quickly. Errors are identified earlier. Reports that once took a week now arrive in minutes. Just one avoided compliance incident could save more than the platform’s yearly cost.

This is the data platform trap: the costs are visible, the benefits are invisible.

So when budgets tighten, data platforms seem like overhead. “Do we really need this?” becomes a reasonable question because nobody built the case.

The solution isn’t better technology; it’s better measurement.

→ Time-to-insight: days to minutes → Cost-per-report: before vs after → Manual hours eliminated per week → Decisions that relied on platform data

One client tracked the analyst’s time spent preparing data. Before the platform: 60% of their week. After: 15%. That’s not an efficiency gain. That’s capacity multiplication.

The CFO isn’t concerned with your architecture; they focus on measurable outcomes. The CDO who can’t translate platform value into business terms will always find themselves defending the budget instead of advocating for an increase.

Try this: pick 2-3 metrics with your CFO. Track them for one quarter. Let the numbers make the case.

Can you quantify the value your data platform delivered last quarter?