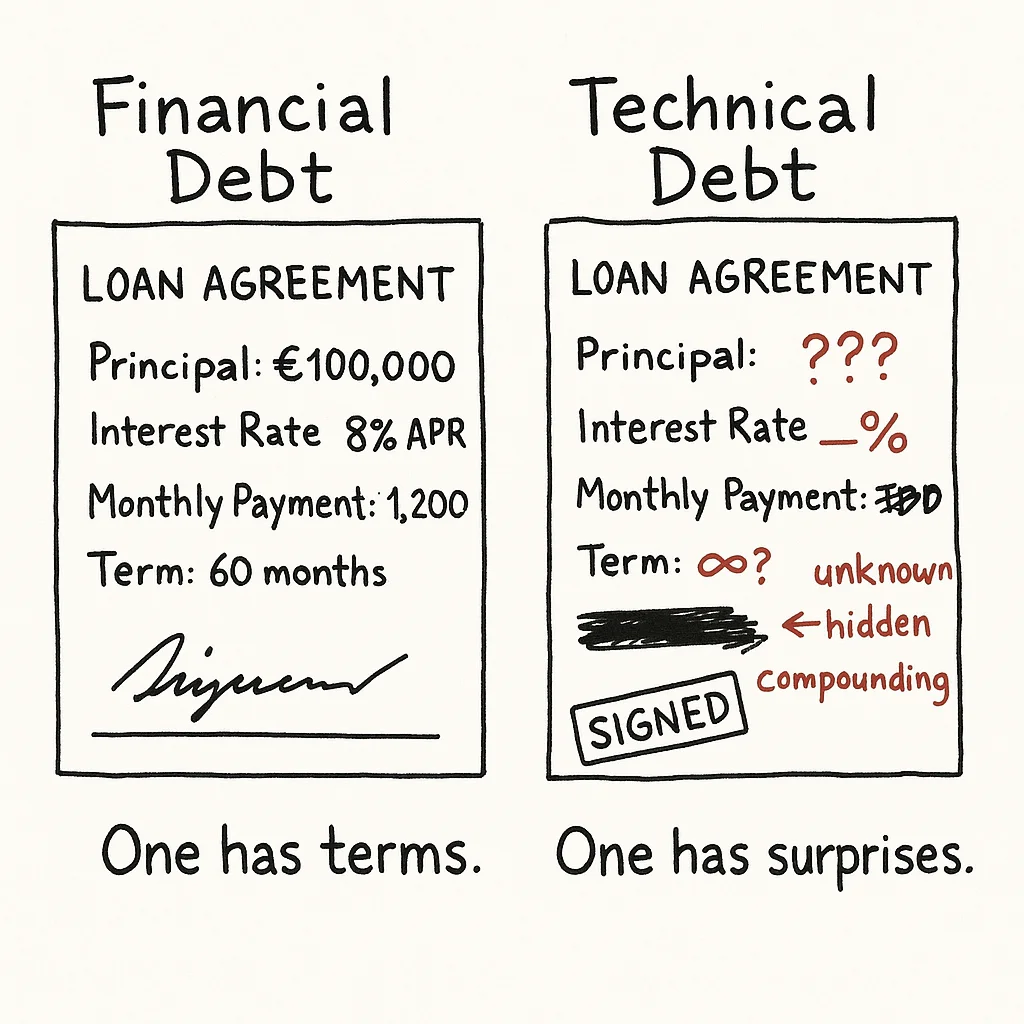

Technical debt compounds faster than financial debt. And nobody tracks the interest rate.

Financial debt has rules. Predictable interest. Clear repayment schedules. Visible on the balance sheet.

Technical debt has no agreed rules, no shared interest rate, and no place on the balance sheet.

Here’s why it’s actually more dangerous than financial debt:

Financial debt is linear. Borrow €100k, pay back €100k plus interest.

Technical debt is exponential. One shortcut forces the next. Workarounds breed workarounds. That “temporary” workaround in your checkout flow is now touched by every new campaign, every new pricing change, every new integration. Each new feature takes longer because it has to navigate the accumulated mess.

And unlike financial debt, technical debt is invisible until it’s catastrophic. Nobody gets fired for a slow deployment pipeline. But everyone notices when releases take weeks instead of days.

The real cost isn’t the debt itself. It’s the opportunity cost: the features you can’t build, the talent you can’t retain, the market windows you miss because your teams are servicing interest instead of shipping value.

CFOs understand compound interest. CTOs need to speak the same language.

What’s your estimated monthly interest payment on technical debt?